Blog

- Home

- Blog

- Page 4

Tabitha Relota

Are You Facing An IRS Tax Audit?

It may evoke dread and anxiety for taxpayers when they face an upcoming IRS

hoffmanestate

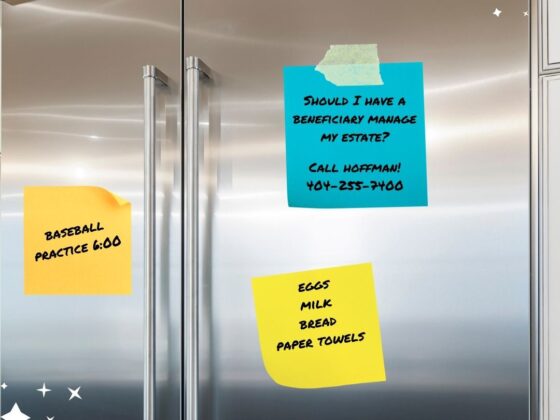

Who Should You Choose To Manage Your Estate?

Should you appoint a beneficiary or a third party to manage your estate? When it

Mike Hoffman

How Can a Buy-Sell Agreement Help Protect Assets For Future Generations?

There are three phases to estate planning. The first phase involves having your “core” documents

Tabitha Relota

Do You Have Unfiled Tax Returns?

You may be anxious and unsure of how to approach unfiled tax returns with the

Tabitha Relota

Do you owe the IRS money?

Taxpayers may face many challenges when dealing with the IRS and may not understand their

Tabitha Relota

Do You Fully Understand Your Payroll Responsibilities As A Business Owner?

There are many responsibilities that fall on business owners. One of the most essential duties

Tabitha Relota

The IRS Announces That They Will Begin Auditing Employee Retention Credit Claims

In 2020, the Employee Retention Credit (ERC) was created by the CARES Act to assist

hoffmanestate

“But I don’t need a Will. I don’t have any Real Assets.”

Even if you do not have children or own property, creating a Will can

hoffmanestate

Does the IRS have Payment Plans?

When it comes to paying taxes owed to the IRS, many people find themselves

hoffmanestate

“You’re the Executor – Now What?”

by HOFFMAN & ASSOCIATES and JIM UNDERWOOD, CPA/PFS, CFP®, AEP, JAMES UNDERWOOD CPA, CFP®

Recent Posts

Hunter Moreland

Year End Estate Planning Tips

Hoffman Estate Law

Happy Scammer Season!

All Categories

Get a Free Consultation

We are here to help.

Call us today to discuss your issue.

Call us today to discuss your issue.