Business

- Home

- Business

- Page 2

hoffmanestate

Business Owners- What to Consider Before Trademarking Your Own Name

A trademark is a word or image that serves to inform consumers of the

hoffmanestate

Is Marriage a Necessary Step?

As older couples contemplate and move forward with divorce, some are starting a second

hoffmanestate

Key Updates of the Consolidated Appropriations Act, 2021

On December 27, 2020, President Trump signed into law the Consolidated Appropriations Act, 2021. Below

Joe Nagel

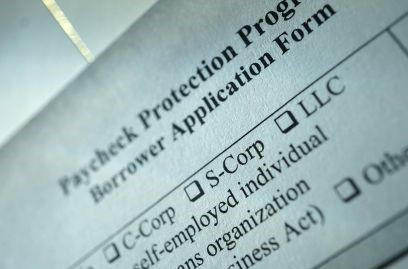

New COVID Relief Package Finalized

By Joe Nagel, Esq., LLM, CPA On December 20, 2020, Congress finally agreed upon

hoffmanestate

Beware The Phantom Hacker Scam

There are many variations of but the majority have simply free text.

Todd Sehhat

Estate Planning For Business Owners

By Todd Sehhat, Esq. When running a business, some owners can be so busy with the

Todd Sehhat

CARES Act: Special Rules for Use of Retirement Funds

By Todd Sehhat, Esq. The Coronavirus Aid, Relief, and Economic Security (CARES) Act provides relief

Todd Sehhat

CARES Act: Waiver of Required Minimum Distribution Rules

By Todd Sehhat, Esq. The Coronavirus Aid, Relief, and Economic Security (CARES) Act waives all

Todd Sehhat

CARES Act: Modifications for Net Operating Losses

By Todd Sehhat, Esq. The Coronavirus Aid, Relief, and Economic Security (CARES) Act provides tax

Todd Sehhat

CARES Act: Employee Retention Credit

By Todd Sehhat, Esq. The Coronavirus Aid, Relief, and Economic Security (CARES) Act includes a

Recent Posts

Mike Hoffman

Preparing for Aging in Place

Mike Hoffman

Estate Planning is a Process, not an Event

All Categories

Tags

Alaina Davalos

asset protection

assets

beneficiaries

beneficiary

Bobby Hoffman

business attorney

business law

CARES Act

Corporate attorney

Credit Shelter Trust

doug mcalpine

Estate

Estate - Tax

estate plan

Estate Planning

estate planning attorney

estate planning attorneys in atlanta

estate planning attorneys in georgia

estate planning attorneys in sandy springs

estate taxes

general power of attorney

georgia

Gift Tax

GRAT

Hoffman & Associates

hoffmanestatelaw.com

IRA

IRS

Joe Nagel

mary daugherty

Mike Hoffman

probate

rhiannon brusco

Roth IRA

taxable estate

tax attorney

tax controversy

tax planning

Todd Sehhat

trust

trustee

trusts

will

wills

Get a Free Consultation

We are here to help.

Call us today to discuss your issue.

Call us today to discuss your issue.